The global fuel market is still adapting to the changes implemented by the IMO 2020. The difference in the sulfur limits, reduced from 3.50% to 0.50%, has widespread effects for the global refining and shipping industries, disrupting the demands for specific bunker fuels.

The demand for high sulfur fuel oil (HSFO) has dropped as shipowners need to explore their ships' options. As a result of the shift from HSFO to very low sulfur fuel oil (VLSFO), the fuel oil market is breaking down into three sectors. JBC Energy notes the market will consist of VLSFO, high sulfur straight-run fuel oil (HSSR), which comes directly from a crude unit, and cracked HSFO (a by-product from sophisticated refining methods).

APC understands the changes the shipping industry is facing. As a provider of coatings to protect your assets, we supply the right coating for your needs. We produce MarineLINE® to protect cargo holds from aggressive marine cargos including methanol. In this article, we discuss the evolution and types of marine fuel oil available today, the technical challenges from blending bunkers, and the demand for fuel oil storage.

Chapters

Chapter 1

Evolution of Marine Fuel Usage

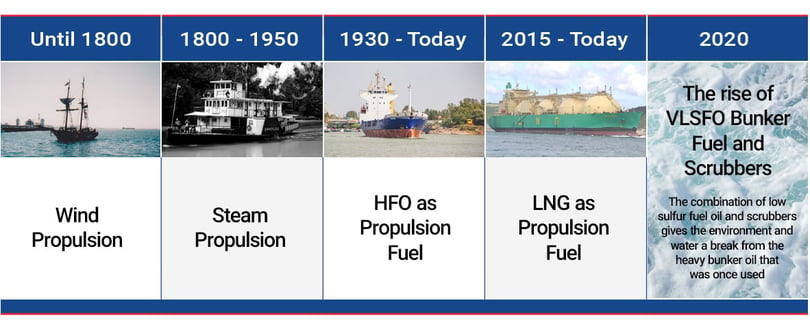

Source: Marine Heavy Fuel Oil (HFO) for Ships

Source: Marine Heavy Fuel Oil (HFO) for Ships

The marine industry is continuously evolving. Since the 1960s, heavy fuel oil (HFO) has ruled the marine environment.

However, its impact on the environment and human health called for a change. The IMO decided to diversify the industry away from HFO into cleaner fuels with less harmful effects on the environment and human health.

As fuel sulfur regulations drive the transition towards low-sulfur fuels and scrubbers, fuel availability, fuel quality, and stability come into play.

Chapter 2

Types of Marine Fuel Oil Available in the Market Today

Fuel used by the shipping industry is derived from petroleum. The fuel can be divided into distillate and residual fuel oil grades.

Distillate Marine Fuel Oil (DM) - are components of crude oil that evaporate in fractional distillation and then condense into liquid fractions. These fuels are commonly known as Marine Gas Oil (MGO) and do not need heating.

Residual Marine Fuel Oil (RM) - is a type of diesel oil which requires higher filtration and needs heating for usage. They are generally considered as low-quality fuels. Residual fuels represent the heavy yields from the refining processes.

Straight-run fuel oils are "produced solely from atmospheric distillation and are generally used as an intermediate feedstock for further processing within the refining system to increase the yields of lighter products."

Cracked fuel oils are used as fuel for power generation, marine bunkers, and large industrial heating plants.

The diversification of marine fuels that comply with the strict emission limits created openings for a variety of new fuels. The DM and RM fuel oils can be further classified into two groups, depending on their sulfur content:

- Ultra-Low Sulfur Fuel Oil (ULSFO)

- Very Low Sulfur Fuel Oil (VLSFO)

Heavy Fuel Oil (HFO) - also referred to as bunker fuel in its lowest quality form. High sulfur fuel oil is one of the dirtiest and less expensive products from a refinery. Lloyds Registry speculates that HFO will represent about 40% of fuel use by 2030.

Liquefied Natural Gas (LNG) - is a cleaner transport fuel and an alternative marine fuel to HFO. LNG offers advantages for ships to meet the emission regulations.

Marine fuels 0.50% is a new blend of fuel designed for use worldwide.

Resource: Full details ISO 8217 Marine Fuels standard

Chapter 3

Marine Fuel Oil: The Future of Fuel Oil After IMO 2020

The refining industry is developing a range of 0.50% sulfur blends. The shipping industry needs to address the addition of the new fuels in 2020.

IMO 2020 means ships can no longer burn untreated high sulfur fuel oil (HSFO). The change presents a challenge to fuel oil producers and ship owners.

It leaves three options available to shippers:

1. Install scrubbers (exhaust gas cleaning systems that extract the sulfur as the HSFO is burned).

2. Switch fuel intake to low sulfur fuel oil, which is equivalent to a distillate. (that could mean accepting higher fuel costs and variations in fuel properties)

3. Switch to liquid natural gas (LNG) propulsion systems.

Possible takeaways:

- Potential for more scrubber fitted ships in the future - which means only ships with scrubbers will be allowed to continue burning HSFO. (while still meeting IMO regulations)

- Crude oil, the raw material processed in a refinery, demands will be high in 2020

- Low sulfur fuel oil prices will increase as a result of higher demand from ship owners

- Fuel costs make up approximately 70-80% of total transport costs. [S&P Global Platts] Therefore, higher fuel costs will significantly impact total shipping costs, and have knock-on effects for globally traded goods.

Resources:

Schroders, IMO 2020 - Short-term implications for the oil market

Chapter 4

Technical Challenges from Blending Bunkers from Different Suppliers

There will be a compelling shift in the blend used to make marine fuels. The concern will come when the products mixed are not compatible with each other. Shipowners are also troubled at mixing different VLSFOs from different producers which could block filters and transfer lines, leading to serious engine problems.

Blending bunkers from different suppliers can result in fuel instability and incompatibility, causing some technical challenges. A few of those challenges could affect:

Viscosity - is a measure of an oil's resistance to flow. It decreases (thins) with increasing temperature and increases (or thickens) with reduced heat.

Cold Flow Properties - indicates the low-temperature operation ability of any fuel and reflects their cold weather. The CFPP is defined as the temperature at which the test filter starts to plug due to fuel components that begin to gel. This causes substantial operability problems. [source]

Flash Point - the temperature at which the vapor of the heated fuel ignites. It's essential to know the minimum temperature at which a vapor-air mixture can be ignited to prevent a fire.

Fame - (Fatty Acid Methyl Ester) is the generic chemical term for biodiesel derived from renewable sources. It is used to extend or replace mineral diesel and gas oil. [source] It can become contaminated and provide conditions for microbial growth.

Chapter 5

Demand for Fuel Oil Storage Post IMO 2020

Fuel switching and the additional demand for lower-sulfur fuels will lead to changes in the global refining market.

Emily Billing, a consultant for McKinsey & Company, and Tim Fitzgibbon, Senior Expert at McKinsey, agree:

"Making VLSFO will require additional tankage and higher logistical costs as low-sulfur streams must be segregated from high-sulfur streams. Companies with bunkering capabilities will have the opportunity to gain new customers, as shipping companies are expected to favor a specific company or brand across the globe to avoid compatibility problems."

Storage demand increases as complexity increases.

Paul Hickin, Associate Director, Oil News S&P Global Platts, states, "The global shipping industry is burning 3.3 million b/d of fuel oil. Even with demand for HSFO falling to 1.1 million b/d, you will still need more storage."

Extra resource:

McKinsey & Company, What shipowners, refiners, and traders should know about IMO 2020

HSFO Demand Split Between Three Competing Sectors

The future fuel choice and decisions are not isolated to the marine industry. The groups include:

- Utilities - where mostly cracked HSFO is burned for power generation.

- Bunkering - where cracked and straight-run HSFO is blended for use as a fuel for scrubber-fitted ships.

- Sophisticated refineries - where HSFO (straight-run or cracked) is either blended with crude or used as a non-crude feedstock.

For the shipping industry, the trend currently is towards shipping smaller volumes of fuel oil directly to end-users. And the bigger VLSFO market will become more lucrative, given its higher value.

Eugene Lindell, a senior consultant at JBC Energy, cites,

source: The Death and Transformation of Fuel Oil, Tank Storage Magazine February/March 2020"The rise of VLSFO as the premier post-IMO bunker fuel of choice is opening up new opportunities for storage and blending operators."

"As the shipping industry retreats from high-sulfur fuel oil as its primary energy source, power generation and industrial uses will increasingly dominate the future of this product." Fuel oil's new buyers

Conclusion

IMO 2020 put forward one of the largest and most prominent challenges in the refining and shipping industries. Shipowners and alike will need to adapt to the changes.

Shipowners will move between VLSFO and MGO, depending on their level of comfort or concern about the new fuel quality and relative price levels. The industry will become more environmentally friendly because of the present regulations.

From APC's perspective, tank owners, operators, and lessors looking to gain the maximum versatility and long service life for their assets need to look at a coating system. Coatings should handle the broadest range of chemicals used in transport, have superior chemical resistance and product purity, clean easily, and be a proven performer in the transport market.